Why Jewelry Prices Will Spike Next Month And What to Buy Now

In the ever-changing landscape of luxury goods, jewelry stands as both a timeless investment and a reflection of global economic forces. Industry experts are now warning of an imminent price surge in the jewelry market next month, creating both challenges and opportunities for savvy consumers. Understanding the factors behind this expected spike can help you make informed purchasing decisions before prices climb.

The Perfect Storm: Why Jewelry Prices Are Set to Increase

Several converging factors are creating ideal conditions for a significant jewelry price increase in the coming weeks.

Rising Precious Metal Costs

Gold and silver prices have been steadily climbing throughout the year, with recent geopolitical tensions accelerating this trend. Gold, in particular, has seen remarkable growth as investors seek safe-haven assets amid economic uncertainty. This fundamental component of fine jewelry is becoming more expensive for manufacturers, who will inevitably pass these costs to consumers.

Supply Chain Disruptions

The jewelry industry continues to grapple with persistent supply chain issues affecting everything from raw material acquisition to finished product delivery. Recent shipping delays and increased transportation costs have further strained the system, creating bottlenecks that drive up prices.

Increased Labor Costs

Skilled jewelry craftsmanship remains in high demand but increasingly short supply. As experienced artisans command higher wages, especially in traditional jewelry-making centers across Europe and Asia, these increased labor costs contribute significantly to the final price tag.

Seasonal Demand Surge

The upcoming holiday season traditionally brings heightened demand for jewelry. With retailers anticipating stronger consumer spending this year following improved economic conditions, many are preparing by adjusting prices upward in anticipation of the seasonal rush.

Luxury Market Positioning

Major jewelry houses have been strategically repositioning their brands in the ultra-luxury segment, implementing planned price increases to enhance exclusivity and brand perception. This trend has a ripple effect across the industry, influencing pricing structures even for more accessible jewelry lines.

What to Buy Now: Strategic Purchases Before the Price Hike

With price increases looming, certain jewelry categories represent particularly smart investments right now.

Classic Gold Pieces

Simple, well-crafted gold jewelry pieces with timeless designs offer excellent value. Focus on items with substantial gold content rather than merely gold-plated options, as these will better retain and potentially increase in value over time. Consider chain necklaces, bangles, and hoop earrings that never go out of style.

Diamond Solitaires

Classic diamond solitaire rings, earrings, and pendants remain consistently desirable. With diamond prices also expected to rise due to supply constraints and growing demand, these pieces represent a dual investment opportunity in both precious metals and gemstones.

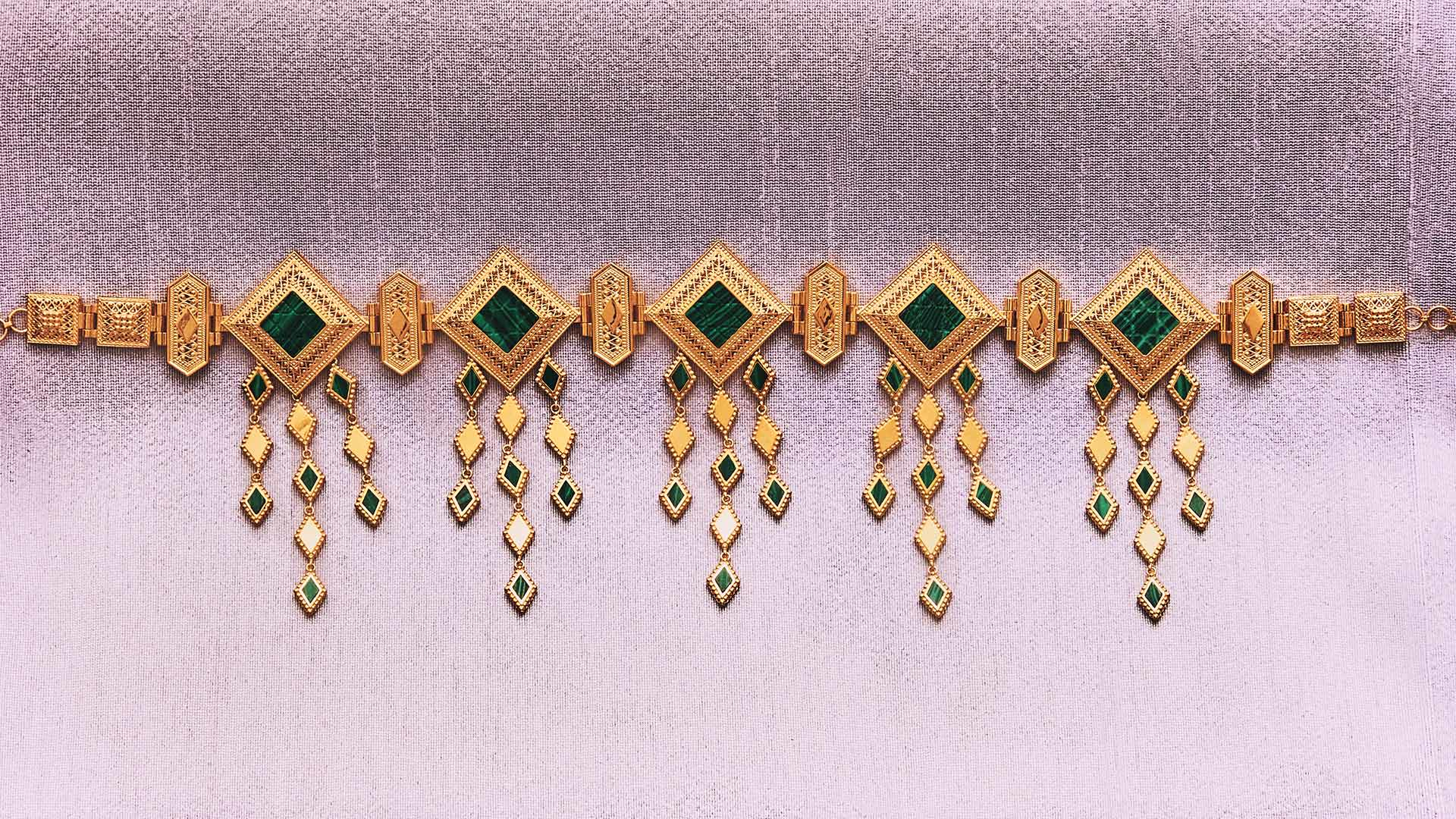

Colored Gemstone Jewelry

Certain colored gemstones are experiencing particular supply challenges, making them smart pre-increase purchases. Sapphires, emeralds, and rubies of high quality have shown impressive value retention and appreciation, especially when set in classic designs that highlight their natural beauty.

Statement Pieces from Established Designers

Signature pieces from recognized designers often appreciate faster than generic jewelry. Look for distinctive designs that showcase the designer's recognizable aesthetic, as these items typically command premium resale values and resist market fluctuations.

Heritage-Inspired Jewelry

Pieces that draw inspiration from historical design periods like Art Deco or Victorian styles tend to maintain their appeal regardless of passing trends. These designs often incorporate intricate craftsmanship that would be prohibitively expensive if created after the anticipated price increases.

Smart Shopping Strategies for Beating the Price Increase

To maximize value before prices rise, consider these practical approaches:

Build Relationships with Jewelers

Established customers often receive advance notice of price increases and may be offered opportunities to purchase at current prices before public announcements. Cultivating relationships with reputable jewelers can provide this valuable insider access.

Consider Estate Jewelry

Pre-owned fine jewelry often represents excellent value, with prices typically less affected by immediate market fluctuations. Quality estate pieces offer the additional benefits of unique character and craftsmanship that may be increasingly difficult to find in new production.

Focus on Craftsmanship Over Brand Names

While luxury brands command premium prices, independent jewelers often provide superior craftsmanship at more reasonable price points. These pieces may experience more modest price increases compared to heavily marketed luxury brands.

Invest in Versatile Pieces

Jewelry that can be worn multiple ways or paired with various outfits offers better value, especially when facing price increases. Convertible pieces that can transform from day to evening wear represent particularly smart investments.

Request Written Valuations

When making significant purchases, obtain detailed written valuations that document the specifications and current market value of your jewelry. These professional appraisals provide important documentation for insurance purposes and establish a baseline value before industry-wide price increases.

Long-Term Perspective: Jewelry as Investment

Beyond aesthetic enjoyment, fine jewelry has historically served as a store of value during economic uncertainty. While not all jewelry appreciates equally, thoughtfully selected pieces can preserve wealth while providing the intangible benefits of beauty and personal connection.

The looming price increases actually reinforce jewelry's status as a tangible asset. Unlike purely decorative purchases that depreciate immediately, quality jewelry often maintains substantial intrinsic value through its precious metal and gemstone content.

Act Thoughtfully, But Promptly

The writing on the wall is clear: jewelry prices are poised for a significant upward adjustment next month. For those considering jewelry purchases in the near future, accelerating those plans could result in substantial savings. By focusing on timeless designs, quality craftsmanship, and pieces with intrinsic value in their materials, consumers can make purchases that both beat the coming price increases and potentially appreciate over time.

While market predictions always carry some uncertainty, the convergence of rising material costs, supply constraints, and seasonal demand patterns creates a compelling case for making informed jewelry purchases now rather than waiting. Whether buying for personal enjoyment or investment purposes, understanding these market dynamics can help you navigate the changing landscape of jewelry pricing.

Our Promise

Fast shipping

Receive your jewelry in maximum 3 days.

Return guaranteed

Requesting a return is quick and easy.

Ethical Sourcing

Ethically Sourced Materials

Payments

Buy in the most convenient way for you.