Beyond the Haram: Navigating Shariah-Compliant Gold Investment & Adornment

Gold has held a special place in Islamic culture for centuries, representing both beauty and wealth while carrying deep spiritual significance. For modern Muslims navigating contemporary financial markets and lifestyle choices, understanding the intersection of Islamic law (Shariah) with gold ownership, investment, and adornment has become increasingly important. This comprehensive guide explores how Muslims can engage with gold in ways that honor their faith while meeting modern financial and aesthetic needs.

Understanding Islamic Perspectives on Gold

Islam provides clear guidance on gold ownership and use, though interpretations can vary among scholars and schools of thought. The fundamental principle centers on intention (niyyah) and the manner of acquisition and use rather than an outright prohibition of gold itself.

Permissible Gold Practices in Islam:

- Women wearing gold jewelry for adornment

- Owning physical gold as a store of value

- Using gold for legitimate trade and commerce

- Gifting gold items for marriages and celebrations

Restricted Practices:

- Men wearing gold jewelry (with some scholarly debate on exceptions)

- Hoarding gold excessively without paying zakat

- Engaging in speculative trading that resembles gambling

- Using gold in prohibited transactions or riba-based investments

Shariah-Compliant Gold Investment Strategies

Modern Muslims have several options for incorporating gold into their investment portfolios while maintaining religious compliance.

Physical Gold Ownership

The most straightforward approach involves purchasing physical gold in the form of coins, bars, or jewelry. This method aligns with traditional Islamic principles as it involves actual ownership of a tangible asset. When buying physical gold, Muslims should ensure they're purchasing from reputable dealers and that the gold meets purity standards.

Key Considerations:

- Storage and security costs

- Authentication and purity verification

- Zakat obligations (2.5% annually on holdings above nisab threshold)

- Market liquidity when selling

Gold-Backed Investment Vehicles

Several modern financial instruments allow Muslims to invest in gold while maintaining Shariah compliance. These include gold ETFs (Exchange-Traded Funds) that are backed by physical gold rather than derivatives or interest-bearing securities.

Shariah-Compliant Features to Look For:

- 100% physical gold backing

- No involvement in prohibited activities

- Transparent fee structures without hidden interest components

- Regular Shariah compliance audits

Islamic Gold Savings Schemes

Many Islamic financial institutions now offer gold accumulation plans that allow gradual investment in gold through regular contributions. These schemes typically involve purchasing fractional ownership of physical gold stored in secure vaults.

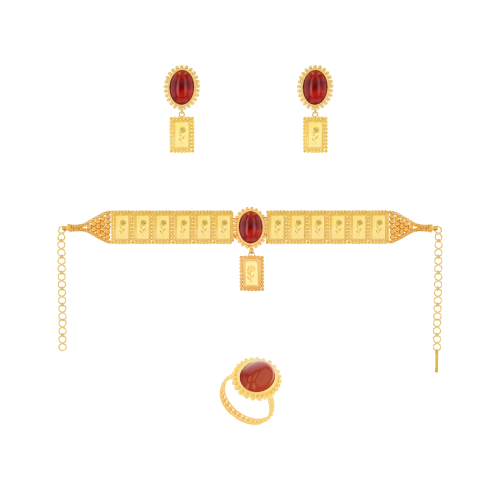

Gold Jewelry: Balancing Faith and Fashion

For Muslim women, gold jewelry represents both personal adornment and cultural heritage. Modern designers are creating pieces that honor Islamic values while embracing contemporary aesthetics.

Choosing Meaningful Designs

Islamic-inspired jewelry often incorporates geometric patterns, calligraphy, and symbols that hold spiritual significance. Popular motifs include:

- Geometric patterns reflecting the infinite nature of Allah

- Calligraphic designs featuring Quranic verses or Islamic phrases

- Crescent and star symbols representing Islamic identity

- Hamsa hand for protection (though views on this vary among scholars)

Quality and Craftsmanship Considerations

When investing in gold jewelry, Muslims should prioritize pieces that will maintain their value and significance over time. This means choosing:

- High gold purity (14k, 18k, or 22k)

- Skilled craftsmanship from reputable jewelers

- Timeless designs that won't quickly go out of style

- Proper certification and documentation

Zakat Obligations and Gold Ownership

One of the most important aspects of gold ownership for Muslims is understanding zakat requirements. Zakat is one of the five pillars of Islam and applies to gold holdings above the nisab threshold.

Calculating Zakat on Gold

The nisab for gold is traditionally set at 87.48 grams (approximately 2.8 troy ounces). If your total gold holdings exceed this amount for a full lunar year, you must pay 2.5% of the total value as zakat.

Important Points:

- Include all gold jewelry regularly worn in calculations

- Use current market prices for valuation

- Consider seeking guidance from Islamic scholars for complex situations

- Factor in zakat when planning gold investments

Modern Challenges and Solutions

Contemporary Muslims face unique challenges when dealing with gold in today's globalized economy.

Digital Gold Platforms

Emerging digital platforms offer fractional gold ownership and trading capabilities. While convenient, Muslims should carefully evaluate these platforms to ensure they comply with Islamic principles and don't involve prohibited elements like excessive speculation or interest-based transactions.

Cultural Considerations

Different Muslim communities have varying traditions regarding gold. South Asian Muslims might emphasize elaborate bridal gold sets, while Middle Eastern communities might focus more on investment-grade pieces. Understanding and respecting these cultural nuances helps maintain community connections while adhering to religious principles.

Balancing Investment and Spirituality

Modern Muslims often struggle with balancing wealth accumulation with spiritual obligations. Gold investment should be approached with the understanding that wealth is a trust from Allah and should be used responsibly for both personal needs and community benefit.

Practical Guidelines for the Modern Muslim

To navigate gold ownership and investment successfully while maintaining faith-based principles:

Do Your Research: Understand both the religious rulings relevant to your school of thought and the practical aspects of gold markets.

Consult Scholars: When in doubt about specific transactions or investment vehicles, seek guidance from qualified Islamic scholars who understand both traditional jurisprudence and modern finance.

Maintain Perspective: Remember that material wealth, including gold, is a means to an end, not an end in itself. Use gold investments to support your family's needs and contribute to your community.

Stay Informed: Islamic finance is an evolving field. Stay updated on new Shariah-compliant investment options and changing scholarly opinions.

Gold remains a valuable and permissible asset for Muslims when approached with proper understanding and intention. Whether for investment purposes or personal adornment, gold can be incorporated into a Muslim's life in ways that enhance both financial security and spiritual well-being. By understanding Islamic principles, staying informed about modern options, and maintaining proper perspective on wealth, Muslims can successfully navigate the golden path between material prosperity and spiritual fulfillment.

The key lies in approaching gold ownership with knowledge, humility, and a clear understanding of one's obligations to both Allah and the community. In doing so, modern Muslims can honor their faith while building sustainable wealth and expressing their cultural identity through beautiful, meaningful gold pieces that will serve them for generations to come.

Our Promise

Fast shipping

Receive your jewelry in maximum 3 days.

Return guaranteed

Requesting a return is quick and easy.

Ethical Sourcing

Ethically Sourced Materials

Payments

Buy in the most convenient way for you.