War and Gold: Exploring the Connection

Introduction: The Interplay Between War and Gold Prices

In the intricate web of global finance, few commodities are as intertwined with geopolitical events as gold. The price of gold is known to sway dramatically in response to shifts in the geopolitical landscape, especially during times of conflict and uncertainty. But what lies beneath this correlation? What factors drive gold prices in the face of war, and what implications does this dynamic have for the broader global economy?

As we delve into the complex realm where geopolitics meets finance, it becomes evident that the relationship between war and gold prices is multifaceted and nuanced. Understanding this relationship requires us to explore not only the immediate impact of armed conflict on gold markets but also the underlying psychological and economic factors that influence investor behavior in times of crisis. Join us as we unravel the mysteries behind the interplay between war and gold prices, shedding light on the intricate dynamics that shape the world of finance in times of turmoil.

Historical Perspective: Wars and Gold Price Trends

Throughout the annals of history, the impact of wars and armed conflicts on the price of gold has been unmistakable. From ancient civilizations to modern-day superpowers, the allure of gold as a safe-haven asset during times of strife has remained steadfast. The historical record is replete with instances where gold prices surged in response to geopolitical tensions and military confrontations.

Dating back to antiquity, gold has served as a reliable store of value in times of crisis. During periods of war, when currencies falter and financial markets falter, investors instinctively turn to gold as a hedge against uncertainty. The intrinsic value and universal acceptance of gold make it an attractive option for preserving wealth amidst the chaos of conflict.

One need only look to the tumultuous events of the 20th century to witness the profound impact of war on gold prices. The two World Wars, in particular, had a seismic effect on global gold markets. During World War I, as nations engaged in a devastating conflict that reshaped the geopolitical landscape, the price of gold soared to unprecedented heights. Similarly, the outbreak of World War II saw a surge in demand for gold as investors sought refuge from the ravages of war.

Geopolitical Tensions: Drivers of Gold Price Volatility

Geopolitical tensions play a crucial role in shaping the trajectory of gold prices. When geopolitical risks escalate, such as the outbreak of armed conflict or the imposition of economic sanctions, investors tend to flock to gold as a safe-haven asset. The fear of geopolitical instability drives up demand for gold, leading to higher prices in the global market.

Gold as a Safe-Haven Asset: The Flight to Safety

Gold has long been regarded as a safe-haven asset due to its intrinsic value, limited supply, and universal acceptance. During times of war and geopolitical turmoil, investors view gold as a reliable store of value that can preserve their wealth and hedge against economic downturns. As a result, demand for gold tends to surge during periods of heightened geopolitical risk, leading to an increase in its price.

Economic Impact: The Ripple Effects of Conflict on Gold Markets

and has implications that reverberate throughout the global economy. As gold prices surge in response to geopolitical unrest, the effects are felt across various sectors, from manufacturing to government finances.

One significant consequence of rising gold prices is the potential for inflationary pressures to emerge. When the cost of gold production and manufacturing increases, businesses often pass these additional expenses onto consumers in the form of higher prices for goods and services. This phenomenon, known as cost-push inflation, can erode purchasing power and diminish living standards, particularly for lower-income households.

Moreover, countries heavily reliant on gold exports may face challenges as gold prices climb. While higher gold prices may initially boost export revenues, they can also lead to volatility in government budgets. Governments dependent on gold revenues may struggle to balance their budgets, especially if they have not adequately diversified their economies or if they lack sufficient fiscal reserves to weather fluctuations in commodity prices.

Speculation vs. Reality: Assessing the True Influence of War on Gold Prices

While wars and geopolitical tensions undoubtedly influence gold prices, the relationship between the two is complex and multifaceted. In some cases, the anticipation of conflict may drive up gold prices even before hostilities begin, as investors preemptively seek out safe-haven assets. However, the actual impact of war on gold prices can vary depending on factors such as the duration and intensity of the conflict, as well as the broader economic environment.

Case Studies: Notable Examples of War's Effect on Gold Prices

Several historical examples illustrate the relationship between war and gold prices. For instance, during major conflicts such as World War I and World War II, gold prices experienced significant spikes as investors sought refuge from the uncertainties of war. Similarly, more recent conflicts, such as the Gulf War and the ongoing conflict in Ukraine, have also led to sharp increases in gold prices due to heightened geopolitical tensions.

Navigating the Intersection of War, Gold, and the Global Economy

In conclusion, the relationship between war and gold prices is a complex and dynamic one that reflects the interplay between geopolitical events, investor sentiment, and economic fundamentals. While wars and armed conflicts can drive up demand for gold as a safe-haven asset, the true impact of war on gold prices depends on a variety of factors. As investors navigate the intersection of war, gold, and the global economy, it's essential to stay informed and consider the broader geopolitical landscape when making.

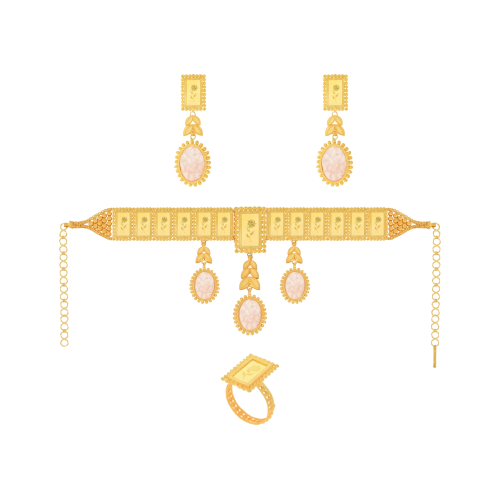

At Al Romaizan Gold & Jewellery, we understand the significance of gold as both a financial asset and a symbol of timeless beauty.

Our Promise

Fast shipping

Receive your jewelry in maximum 3 days.

Return guaranteed

Requesting a return is quick and easy.

Ethical Sourcing

Ethically Sourced Materials

Payments

Buy in the most convenient way for you.