Exploring Gold's Impact on Diversifying Investment Portfolios

In recent economic turbulence, from stock market struggles to inflation, investors are turning to gold to fortify their investment portfolios against uncertainty and diversify amidst market volatility.

This guide will explore how gold investments can assist you in achieving equilibrium within your investment portfolios and effectively managing risk.

Historical Stability of Gold as a Haven

Gold has garnered lasting esteem due to its historical reliability, earning the designation of a “haven" asset during economic uncertainty.

Gold has demonstrated resilience for centuries, maintaining its intrinsic value even during market fluctuations and geopolitical unrest.

An important reason behind the historical stability of gold is its tangible nature and limited supply. Gold is a finite resource, unlike fiat currencies, which can be susceptible to inflation and devaluation.

This scarcity contributes to its ability to retain value over time and provides a sense of security for investors seeking a reliable store of wealth.

Diversification Benefits of Including Gold

While investing, building a robust and well-balanced portfolio is a continuous pursuit. Gold is one strategy continuously shown to be a beneficial asset in this undertaking.

The benefits of including gold in your investment portfolio will be discussed in this part, along with how it enhances other assets, stabilises the market, and helps with risk management.

Minimizing Portfolio Fluctuations and Currency Risks

Gold investments generally correlate poorly with other asset classes, such as bonds and equities. This implies that gold may stabilise your portfolio during turbulent times in the stock market.

Gold investments also offer a potential safeguard against currency risk, particularly when gold prices are quoted in a specific currency. In instances of depreciation in the local currency against the quoted currency, gold investments can protect investors.

Potential for Value Growth

Over the long run, gold has shown a consistent and long-lasting pattern of capital appreciation. This timeless quality stems from many things, such as its inherent worth, scarcity, and historical function as a repository of wealth.

Gold is often sought after by investors when looking for a hedge against inflation or to preserve and expand their cash. This is especially true in difficult economic times.

Potential of Rebalancing the Portfolio

Adding gold to your investment portfolio allows you to profit from rebalancing opportunities.

One may maintain the allocated asset allocation and possibly increase total returns by periodically selling high-performing assets and buying low-performing ones. This tactical move navigates market fluctuations and guarantees alignment with investment aims.

Gold's Performance in Different Market Conditions

Gold's performance in various market conditions reflects its unique role as a versatile asset.

During times of economic expansion, gold may experience muted returns compared to riskier assets like stocks.

Investors often allocate a smaller proportion of their portfolios to gold when economic prospects are positive; however, the scenario shifts during economic downturns or market contractions.

Gold might not yield the same returns as riskier assets during prosperous economic times. However, its capacity to function as a hedge during downturns makes it a valuable addition for investors seeking to protect their portfolios from various market risks and uncertainties.

Investors looking to create flexible and robust portfolios that can withstand various economic situations must thoroughly understand how gold behaves in different market environments.

Practical Aspect of Gold Investments

When adding gold to diversify your investment portfolio, you should carefully consider your investing objectives, desired ownership structure, and how market dynamics affect gold prices.

Various investment options are available with gold, including shares in gold mining firms, exchange-traded funds (ETFs), and actual gold.

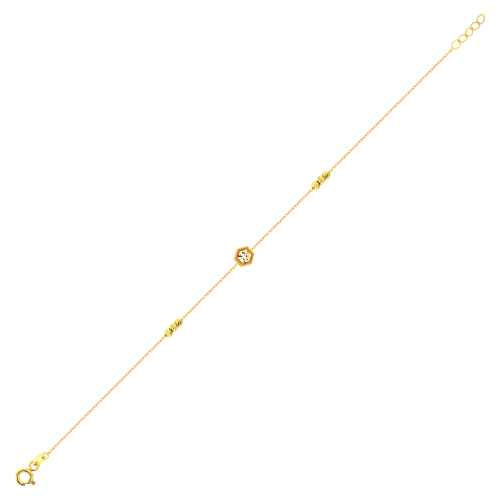

Physical Gold

Possessing physical gold, such as coins or bars, guarantees a palpable and tangible asset within one's investment portfolio.

However, they must be stored securely, adding expenses and administrative difficulties to your investment plan.

Gold ETFs

However, one easy way to get exposure to gold without storing any physical gold is through exchange-traded funds (ETFs).

Investing in gold ETFs is a simple and handy way for investors to track the performance of the metal without having to own any of it physically. They operate similarly to conventional ETFs and are traded on stock exchanges, allowing investors to purchase and sell shares anytime throughout the trading day.

Final Thoughts

Implementing a diversification strategy within your investment portfolio is a foundational approach to risk management and pursuing long-term financial objectives.

For investors looking for stability and risk reduction, gold is a desirable alternative because of its potential to act as a buffer against inflation, stock market volatility, and economic concerns.

Gold may be a good addition to your portfolio, but before you buy, understand the risks and your investing objectives.

Our Promise

Fast shipping

Receive your jewelry in maximum 3 days.

Return guaranteed

Requesting a return is quick and easy.

Ethical Sourcing

Ethically Sourced Materials

Payments

Buy in the most convenient way for you.