UAE's Traditional Gold Investment Meets Modern Technology

UAE is a Golden Bridge Between Heritage and Innovation:

In the heart of the Middle East, where ancient trade routes once carried precious metals across vast deserts, the United Arab Emirates stands as a testament to the enduring value of gold. Today, this nation is writing a new chapter in its golden history, seamlessly blending its deep-rooted traditional gold investment practices with cutting-edge technology.

The Golden Heritage:

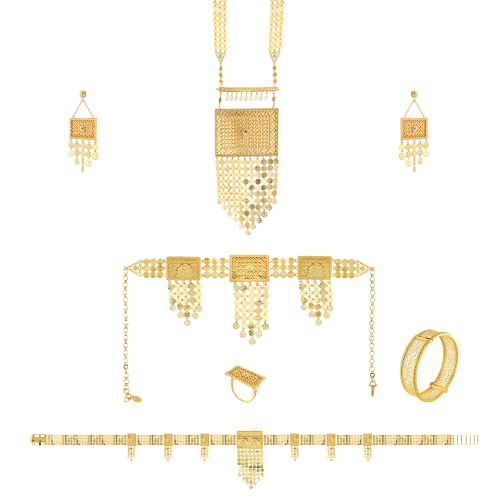

The UAE's relationship with gold is as old as its trading history. For generations, Emiratis have considered gold not just a luxury but a fundamental store of value. The bustling Gold Souk in Dubai, with its glittering displays and negotiating traders, continues to serve as a living museum of this heritage, attracting millions of visitors annually and facilitating billions in transactions. Traditional investment in gold here has always been deeply personal. Families pass down gold jewelry as inheritance, and major life events are marked by gold gifts. This cultural affinity for the precious metal has helped establish Dubai as one of the world's leading gold trading hubs, with annual trade volumes exceeding $75 billion.

Digital Transformation:

However, the UAE is not content to rest on its traditional laurels. The nation is actively embracing technological innovation in the gold sector, creating a unique hybrid model that honors tradition while pushing boundaries. Digital gold trading platforms, blockchain-based gold certificates, and gold-backed cryptocurrencies are rapidly gaining traction. The Dubai Gold & Commodities Exchange (DGCX) has revolutionized how gold is traded in the region. Through its electronic trading platform, investors can now trade gold futures and options with the same ease as trading stocks. The introduction of mobile apps for gold trading has democratized access, allowing smaller investors to participate in the market with minimal initial investment.

Blockchain and the New Gold Standard:

Perhaps the most significant technological advancement in the UAE's gold sector is the integration of blockchain technology. The Dubai Multi Commodities Centre (DMCC) has launched several initiatives that use blockchain to track gold from mine to market, ensuring authenticity and reducing the risk of fraud. This technology creates an immutable record of each gold bar's journey, providing unprecedented transparency in a market where trust is paramount.

The UAE has also pioneered the concept of "digital gold." Through various platforms, investors can now purchase gold digitally, with their ownership recorded on the blockchain. These digital certificates are backed by physical gold stored in secure vaults, combining the security of traditional gold investment with the convenience of digital transactions.

Impact on Global Markets:

The UAE's innovative approach to gold investment has positioned it as a bridge between traditional and modern markets. Asian investors, particularly from India and China, who have historically favored physical gold, are increasingly engaging with the UAE's digital gold platforms. Meanwhile, Western institutional investors are attracted by the robust regulatory framework and technological infrastructure. This fusion of old and new has helped the UAE maintain its competitive edge in the global gold market. The country now handles an estimated 20–25% of the world's physical gold trade, with technology playing a crucial role in facilitating these transactions.

Challenges and Opportunities:

Despite the successful integration of technology, challenges remain. The traditional sector, particularly small traders in the gold souks, sometimes struggles to adapt to digital systems. Additionally, ensuring cybersecurity for digital gold platforms and maintaining the integrity of blockchain records requires constant vigilance and investment. However, these challenges are outweighed by the opportunities. The UAE's gold market is becoming more accessible, efficient, and transparent. Young investors, who might have previously viewed gold as outdated, are being drawn to the market through user-friendly digital platforms.

The Future of Gold Investment:

Looking ahead, the UAE is positioning itself at the forefront of gold market innovation. Plans are underway to develop artificial intelligence systems for price prediction, enhanced blockchain tracking systems, and even more sophisticated digital trading platforms. The success of this hybrid model, where traditional gold trading coexists with and is enhanced by modern technology, could serve as a blueprint for other traditional markets looking to modernize while preserving their heritage. As the world moves towards an increasingly digital future, the UAE's approach demonstrates that traditional assets like gold can remain relevant and valuable when adapted to modern needs. This golden bridge between heritage and innovation ensures that the Emirates will continue to shine in the global gold market for generations to come.

In this era of rapid technological advancement, the UAE's gold market stands as a shining example of how traditional investment practices can be enhanced rather than replaced by technology, creating a stronger, more accessible, and more efficient market for all participants.